The vivid pictures and appalling actions in Washington, D.C., Wednesday captured the attention of the globe, but not the interest of markets. The Democratic sweep in the Georgia Senate races didn’t attract a lot of interest from investors either. Neither were markets fazed by the first loss of jobs in a monthly employment report since the recovery began.

Key Points for the Week

- Markets had muted reactions to the chaos in Washington.

- Restrictions on dining designed to contain the spread of COVID-19 caused the labor market to lose 140,000 jobs last month.

- Outside of the restaurant industry and local governments, employment growth remained robust.

Instead, markets started the new year strongly. The S&P 500 soared 1.9% and reached another new high. The MSCI ACWI climbed 2.7% last week, supported by strong returns in developed and emerging markets. The Bloomberg BarCap US Aggregate Bond Index slid 0.9% as interest rates increased in anticipation of higher government spending during the next administration.

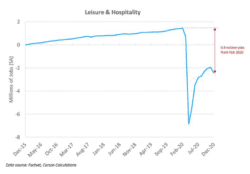

In economic news, U.S. payrolls shrank 140,000 in December. The unemployment rate remained at 6.7%. The cause for the decline was easy to spot. Regulations enacted to reduce the spread of COVID-19 contributed to 370,000 workers at dining establishments losing their jobs. Those losses, along with other cutbacks in the leisure and hospitality industry, contributed to the industry shedding 498,000 jobs (Figure 1). Without those reductions, employment would have grown a respectable 358,000. Job growth in business services, retail, and construction helped offset some of the decline. As states ease restrictions on indoor and outdoor dining, many of the jobs are likely to come back.

Next week we can look forward to some interesting discussions in Washington that are likely to get lots of media attention and could affect markets. Markets will likely focus on early corporate earnings and U.S. retail sales data for the important Christmas season.

Figure 1

Not Nearly as Bad as it Looked

December’s employment report looked bad on the surface but turned out to not be nearly as bad as it looked. The overall numbers were disappointing. Expectations for growth of 100,000 jobs were missed. Instead, the economy shed 140,000 jobs.

Further examination of the data showed hiring was reasonably strong, except in two sectors. Leisure and hospitality, which includes eating and drinking establishments, shed 498,000 jobs. Some states tightened restrictions on dining to reduce the spread of a COVID outbreak, and layoffs resulted. Government employment dropped 45,000 jobs as state and local governments reduced staff and education employment continued to contract.

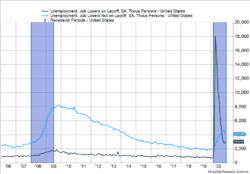

The good news is many of the people who lost their jobs view their unemployment as temporary. When the restrictions begin to loosen, they expect to be rehired. As Figure 2 shows, the number of workers who view their unemployment as permanent dropped last month. If this decline becomes a trend, it may mean the economy will begin healing at a more rapid rate.

As the COVID-19 vaccines become more widely distributed, restaurants are a likely early beneficiary. The initial vaccine shots are primarily being directed to health care workers and nursing home patients. These groups help reduce health risks, but healthier nursing home patients won’t boost the economy much as their lowered mobility makes it unlikely they will adjust their spending habits after receiving the vaccine.

Figure 2

When the vaccine is provided to individuals with greater mobility, restaurants become a natural outlet. Dining doesn’t require the management of large crowds, so individual immunity can turn into demand very quickly. Venue-driven activities, such as sports and concerts, will likely recover later.

Education hiring is also likely to pick up as more schools open for students on a consistent basis. The recent stimulus package will provide consumers more money to spend. That spending creates sales tax revenue and acts as a stealth support package for cities and states strapped for cash.

How soon will the recovery begin? The slow distribution of vaccine shots is pushing that date out. It is also likely people will scale back existing activities as they get closer to getting the first shot and may continue to scale back until getting the second shot, allowing the vaccine to take hold.

Numbers will likely start to improve in the spring, and improvement should accelerate in the summer. The faster the vaccine is distributed the more quickly the situation will turn.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bls.gov/news.release/empsit.nr0.htm#

Compliance Case: 00920727